All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Roth 401(k) payments are made with after-tax contributions and after that can be accessed (incomes and all) tax-free in retired life. Returns and funding gains are not strained in a 401(k) strategy. Which item is finest? This is not an either-or choice as the items are not replacements. 401(k) strategies are developed to assist employees and service owners build retirement savings with tax obligation advantages plus get potential company matching payments (complimentary included money).

IUL or term life insurance policy may be a requirement if you wish to pass cash to beneficiaries and do not think your retired life savings will certainly satisfy the objectives you have specified. This material is meant only as general info for your ease and should never be understood as financial investment or tax advice by ShareBuilder 401k.

Iul Vs Term Life

Your monetary situation is one-of-a-kind, so it is essential to discover a life insurance policy product that fulfills your details demands. If you're looking for life time coverage, indexed universal life insurance policy is one alternative you may want to take into consideration. Like various other long-term life insurance products, these plans enable you to develop money value you can touch throughout your lifetime.

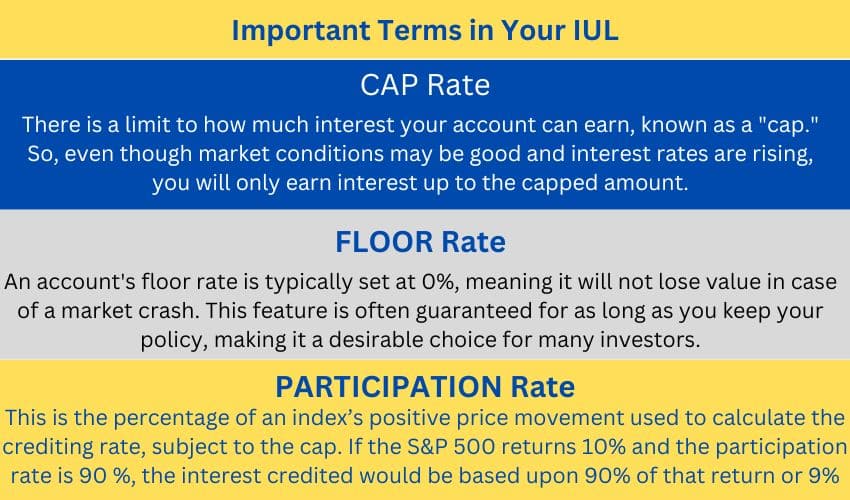

That means you have a lot more long-term development potential than an entire life policy, which provides a set rate of return. However you also experience more volatility because your returns aren't assured. Usually, IUL plans avoid you from experiencing losses in years when the index loses value. Nonetheless, they also cap your rate of interest credit history when the index goes up.

As long as you pay the costs, the plan continues to be in force for your entire life. You can collect money worth you can make use of during your lifetime for numerous economic needs.

Long-term life insurance coverage plans usually have higher initial premiums than term insurance, so it may not be the best choice if you get on a tight budget plan. The cap on rate of interest credit ratings can restrict the upside potential in years when the supply market executes well. Your policy can lapse if you secure also large of a withdrawal or plan financing.

With the possibility for more robust returns and flexible payments, indexed global life insurance may be an alternative you want to take into consideration., who can examine your individual circumstance and provide customized understanding.

Iscte Iul Contactos

The information and descriptions had below are not intended to be total summaries of all terms, conditions and exemptions relevant to the products and solutions. The accurate insurance protection under any kind of nation Investors insurance policy product undergoes the terms, problems and exemptions in the actual policies as released. Products and solutions explained in this web site vary from one state to another and not all items, insurance coverages or services are available in all states.

If your IUL policy has sufficient cash money value, you can obtain against it with versatile repayment terms and reduced rates of interest. The choice to develop an IUL policy that mirrors your specific requirements and situation. With an indexed universal life policy, you designate costs to an Indexed Account, therefore developing a Sector and the 12-month Segment Term for that sector starts.

Withdrawals may occur. At the end of the segment term, each segment gains an Indexed Debt. The Indexed Debt is determined from the modification of the S&P 500 * during that one- year period and is subject to the limits declared for that segment. An Indexed Credit score is computed for a sector if worth continues to be in the sector at section maturity.

These restrictions are figured out at the beginning of the section term and are guaranteed for the entire section term. There are 4 choices of Indexed Accounts (Indexed Account A, B, C, and E) and each has a various type of limit. Indexed Account A sets a cap on the Indexed Credit report for a sector.

The development cap will certainly differ and be reset at the start of a segment term. The participation price determines just how much of an increase in the S&P 500's * Index Value relates to segments in Indexed Account B. Higher minimum development cap than Indexed Account A and an Indexed Account Charge.

Indexed Universal Life Insurance 2025

There is an Indexed Account Fee associated with the Indexed Account Multiplier. No matter of which Indexed Account you choose, your cash worth is constantly safeguarded from unfavorable market performance.

At Section Maturity an Indexed Credit history is determined from the change in the S&P 500 *. The worth in the Segment earns an Indexed Credit scores which is determined from an Index Development Price. That growth price is a percentage modification in the current index from the beginning of a Segment until the Section Maturity date.

Sections immediately renew for one more Sector Term unless a transfer is requested. Costs got considering that the last sweep date and any type of asked for transfers are rolled into the exact same Sector to make sure that for any month, there will certainly be a solitary new Sector produced for an offered Indexed Account.

Best Equity Indexed Universal Life Insurance

In truth, you might not have actually believed much about just how you wish to spend your retirement years, though you most likely recognize that you don't desire to lack cash and you 'd like to keep your existing way of living. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] In the past, people trusted three main incomes in their retirement: a firm pension plan, Social Safety and whatever they would certainly taken care of to save.

Fewer employers are supplying standard pension. And several business have lowered or discontinued their retired life strategies. And your ability to rely only on Social Safety and security remains in concern. Even if advantages haven't been minimized by the time you retire, Social Security alone was never ever intended to be enough to pay for the lifestyle you want and should have.

401k Vs Iul

While IUL insurance might prove valuable to some, it is necessary to recognize exactly how it functions before buying a policy. There are numerous pros and disadvantages in contrast to various other forms of life insurance policy. Indexed universal life (IUL) insurance plan offer greater upside potential, versatility, and tax-free gains. This type of life insurance policy provides irreversible protection as long as premiums are paid.

As the index moves up or down, so does the price of return on the cash money worth component of your policy. The insurance policy business that issues the policy might supply a minimal guaranteed price of return.

Monetary specialists typically recommend living insurance policy coverage that amounts 10 to 15 times your annual income. There are a number of disadvantages related to IUL insurance coverage that critics are fast to explain. For instance, a person who develops the policy over a time when the marketplace is executing inadequately could wind up with high costs repayments that don't add whatsoever to the cash value.

Aside from that, maintain in mind the following various other considerations: Insurer can establish participation prices for exactly how much of the index return you get each year. Let's state the policy has a 70% participation rate. If the index grows by 10%, your cash worth return would certainly be just 7% (10% x 70%).

Furthermore, returns on equity indexes are frequently topped at a maximum quantity. A policy could claim your maximum return is 10% each year, despite how well the index executes. These restrictions can limit the real rate of return that's attributed towards your account annually, no matter of exactly how well the policy's underlying index carries out.

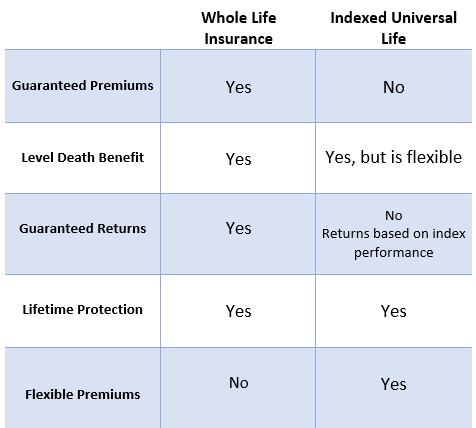

It's essential to consider your personal risk resistance and investment goals to make sure that either one lines up with your overall strategy. Whole life insurance plans commonly include an assured rates of interest with foreseeable premium quantities throughout the life of the policy. IUL policies, on the various other hand, offer returns based on an index and have variable premiums with time.

Latest Posts

Freedom Global Iul Ii

Indexed Universal Life Insurance - Protective

Università Telematica Degli Studi Iul